Regulatory Compliance

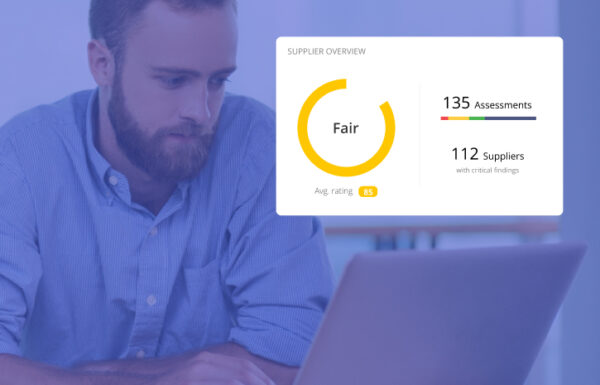

Easily Check If Your Suppliers Comply with Regulations

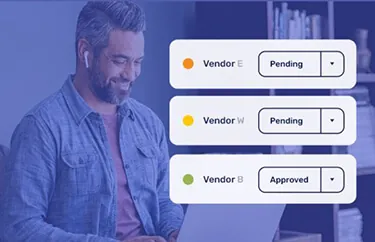

You determine who needs to comply, and Panorays checks that they do.

Book a Demo

Business Relationship & Criticality

Third parties being tested for compliance must be segmented by their criticality and business relationship. Panorays makes it simple to do so with checking a few boxes, defining how critical the vendor is to the business and how the company interacts with it.

Compliance

When identifying a new vendor, check the “PCI” box and the vendor will receive a security inquiry that will ask about each of the 12 PCI controls. Panorays will grade the vendor’s responses and identify any missing policies.

Business Enablement

Financial services regulations like OCC 2013-29 and EBA prescribe a set of processes for checking your third party partners. Panorays helps by acting as your central repository of third parties.

Quick GDPR Readiness Rating

The Smart Questionnaire™ includes a separate scale representing the third party’s readiness for GDPR. The scale ranges from no readiness to full compliance.

Essential Regulatory Documentation

Panorays offers an efficient framework for maintaining the documentation for process-oriented regulations like OCC and EBA. No more spreadsheets; everything is on the platform.

Continuous Compliance with Policies

Panorays continuously monitors third parties for new issues and reports specific findings that may cause a problem for compliance to regulations like GDPR, NYDFS and security standards like NIST, ISO 2700x and PCI DSS.

Panorays provides one location where all relevant teams can connect and find information that they need without calling or meeting with each other.

Sam Potashnick

Information Systems Team Leader

Information Systems Team Leader

Hundreds of teams evaluate and manage their vendors’ security with Panorays